Britain is held back by its business culture, not the EU

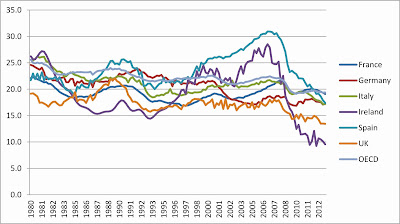

ACHTERGROND - British ministers like to talk of the British economy being in a ‘global race’, and of the need for their countrymen to shape up and raise their game if they are to compete in the global economy. In practice, they mean less red tape, tax cuts for business, and reforms aimed at making it easier to hire and fire employees. Many Conservatives blame the regulatory burden on the EU, and want to either renegotiate the terms of Britain’s membership or withdraw altogether. With the notable exception of Liberal Democrat Business Secretary, Vince Cable, these ministers never mention business short-termism, and the British system of corporate governance that encourages it. Yet this is undoubtedly the most important reason for the UK now having the second lowest investment rate in the OECD (after Ireland, where investment is very volatile). The government wants to rebalance the UK economy towards investment and exports. This will require a reform of corporate governance, especially the incentives faced by executives.

Damagingly low

British ‘short-termism’ has long been blamed for the country’s low levels of investment, especially in manufacturing where success requires long-term commitment to product development and distribution as well as to training. The issue received less attention during the boom years when debt-fuelled private consumption and (towards the end) deficit spending by government drove growth, but it hardly went away. There is no perfect correlation between the level of investment and the rate of economic growth – too much investment can be wasteful and unproductive, as was the case in Ireland and Spain in the run-up to the crisis. But Britain’s investment rate is clearly damagingly low. The country’s corporate sector became a net saver in 2002, and hence long before the onset of economic crisis. Profits have risen and investment has fallen, as the corporate sector – in a reversal of the normal order of things – has become a large creditor to the rest of the economy.